Navigating the world of personal loans could be challenging, especially for individuals with unhealthy credit score. In Greensboro, North Carolina, the panorama for personal loans is numerous, with numerous options accessible for individuals who might have confronted financial setbacks. In case you loved this article and you would want to receive more details with regards to 20000 personal loan bad credit, click here to investigate, i implore you to visit the web site. This report aims to provide a detailed overview of personal loans for bad credit in Greensboro, protecting the varieties of loans obtainable, the appliance process, eligibility criteria, and ideas for securing a loan.

Understanding Unhealthy Credit

Unhealthy credit usually refers to a low credit rating, which might result from missed funds, high debt ranges, or different monetary missteps. In the United States, credit score scores range from 300 to 850, with scores under 580 typically considered poor. Individuals with dangerous credit score might discover it troublesome to qualify for traditional loans or could face greater interest rates, making it essential to know different lending options accessible in Greensboro.

Kinds of Personal Loans for Bad Credit

- Secured Personal Loans: These loans require collateral, comparable to a car or financial savings account, which can assist decrease the lender's risk. For the reason that loan is backed by an asset, secured loans often include lower curiosity rates compared to unsecured loans.

- Unsecured Personal Loans: Unsecured loans don't require collateral, making them riskier for lenders. As a result, individuals with dangerous credit may face higher interest rates. Nonetheless, some lenders specialize in providing unsecured loans to borrowers with poor credit score histories.

- Payday Loans: These short-term loans are designed easiest way to get a personal loan with bad credit cover fast expenses till the borrower receives their subsequent paycheck. Whereas they're straightforward to acquire, payday loans typically come with extremely excessive-curiosity charges and charges, making them a dangerous alternative for these with unhealthy credit score.

- Credit score Union Loans: Native credit score unions in Greensboro may offer personal loans with bad credit history loans to members with bad credit. These loans often have extra favorable phrases in comparison with traditional banks, as credit score unions are nonprofit organizations focused on serving their members.

- Peer-to-Peer Lending: On-line platforms join borrowers with individual buyers willing to fund loans. This feature could be helpful for those with bad credit score, as investors may be extra flexible than conventional lenders.

Application Course of

Making use of for a personal loan in Greensboro entails several steps:

- Research Lenders: Start by researching lenders that specialize in dangerous credit loans. Compare interest charges, fees, and repayment phrases to find the perfect option.

- Verify Your Credit score Score: Before applying, check your credit score to grasp where you stand. This could enable you identify lenders that cater to your credit profile.

- Collect Documentation: Most lenders will require documentation, including proof of income, employment verification, and identification. Be prepared to offer these paperwork when applying.

- Submit Your Utility: Fill out the loan utility with correct information. Some lenders could offer online applications for comfort.

- Overview Loan Gives: When you obtain loan affords, carefully review the terms, including curiosity charges, fees, and repayment schedules. Be sure you perceive the entire value of the loan.

- Accept the Loan: In the event you find a loan supply that meets your wants, settle for the terms and sign the settlement. Bear in mind of any prepayment penalties or other circumstances.

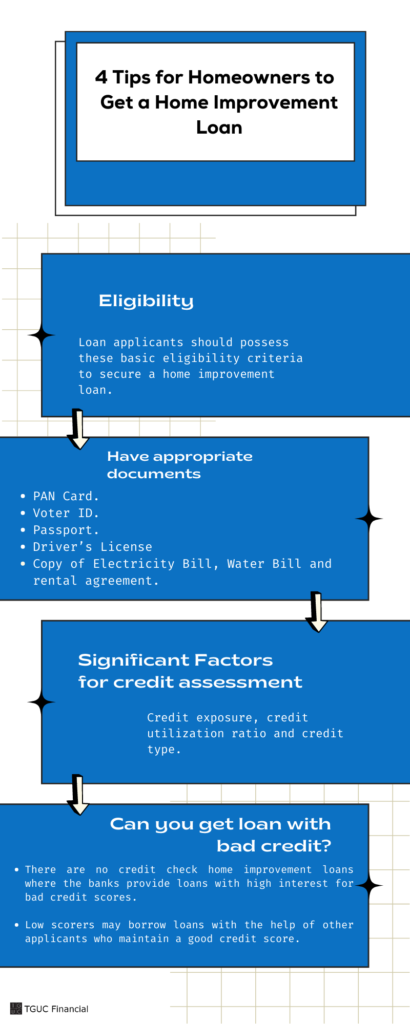

Eligibility Standards

Whereas eligibility requirements differ by lender, widespread criteria for personal loans for bad credit embody:

- Age: Borrowers have to be at the least 18 years old.

- Income: Proof of stable revenue is important to exhibit the best personal loans for bad credit power to repay the loan.

- Residency: Candidates should be residents of Greensboro, NC.

- Credit score History: While bad credit could not disqualify you, lenders will still review your credit score historical past to evaluate risk.

Tips for Securing a Personal Loan

- Improve Your Credit score Score: Earlier than applying for a loan, take steps to improve your credit score. This may embrace paying off present debts, making well timed funds, and disputing any inaccuracies on your credit score report.

- Consider a Co-Signer: If possible, find a co-signer with good credit score to extend your probabilities of loan approval. A co-signer agrees to take duty for the loan if you default, lowering the lender's threat.

- Select a good Lender: Analysis lenders completely to keep away from predatory lending practices. Search for opinions and scores from earlier borrowers to ensure you might be coping with a reputable institution.

- Start with Native Credit score Unions: Local credit score unions typically have extra lenient lending standards and should supply decrease curiosity rates than traditional banks.

- Put together for Increased Curiosity Rates: Understand that loans for bad credit typically come with increased curiosity rates. Issue this into your funds and ensure you can afford the monthly funds.

- Read the High quality Print: Earlier than signing any loan settlement, learn the terms carefully. Concentrate to interest rates, fees, and repayment terms to avoid surprises down the road.

Conclusion

Obtaining a personal loans for bad credit no cosigner loan with dangerous credit in Greensboro, NC, is feasible, although it may require some additional effort and analysis. By understanding the kinds of loans obtainable, following the application course of, and adhering to eligibility criteria, individuals can safe the funding they need. With careful planning and consideration, borrowers can enhance their financial state of affairs and work in direction of rebuilding their credit score over time.